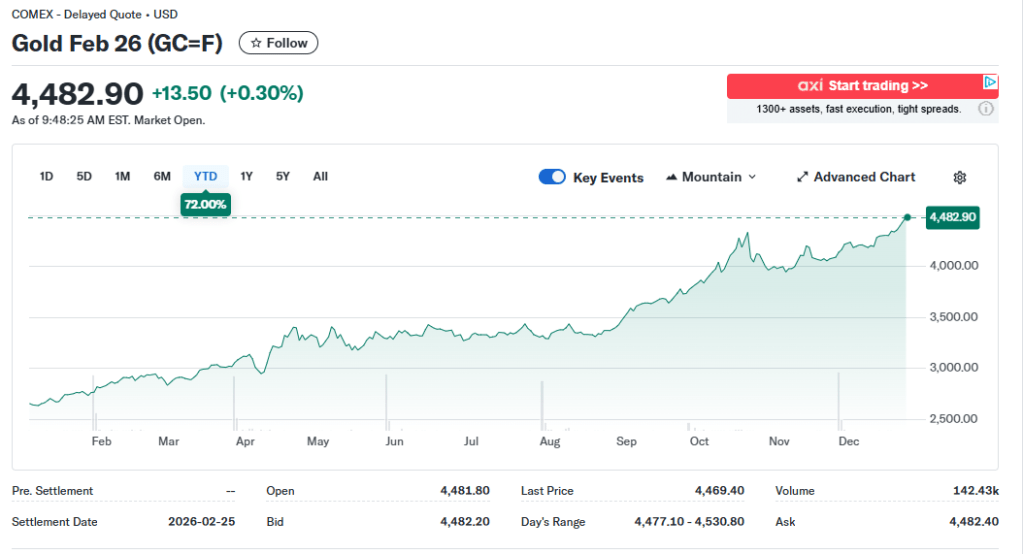

You wanna see something nuts? Check out this chart.

A year ago today, on 23 December 2024, gold traded at USD$2,612 per oz.

Today, 23 December 2025, gold trades at USD$4,482 per oz.

That is 72 percent increase year over year, folks. 72 fucking percentage points.

Insane, right?!

What could have driven gold this high, this fast, and what’s even nuttier, this stratospheric price hike, doesn’t seem to have a ceiling in sight? What is driving it?

To me, this is a simply mathematical equation.

On one side we have a commodity, Gold, which has always had its ups and downs, depending on its supply and demand.

On the other side we have an unknown, let’s mark it X.

The price of stuff is determined by people.

People are emotional beings. We are driven by emotions more than we are by reason.

You know this to be true because you, too, have barged into the kitchen and scared the living lights out of your wife, who wasn’t expecting to see you so close behind her back. Did she yell at ya? Of course, she did. You scared her, you bastard, you. 🙂

Same thing happens with the price of commodities on the stock exchange market. The market is as jittery as a scaredy cat. Not just sometimes but all the time.

Supply and demand is a big factor too but unless the mines stopped bringing ore up and plants stopped refining it at the beginning of 2025, which btw spoiler alert – didn’t happen, then something else must be driving the price of gold sky high.

But just to be on the safe side, let us see the facts.

Supply side

In 2025, global gold production reached a historic high, surpassing 3,750 tonnes. Some miners like Equinox are projecting a production upwards of 900,000 ounces of Au, or some 29 tonnes. That is one company, folks, just one. If you are into mining, go for gold, I tell you. It’s shiny, you can make a living, you’ll love it.

| Country (gold production) (2025) | Tonnes |

| China | 380 |

| Russia | 310 |

| Australia | 290 |

| Canada | 200 |

| United States | 160 |

| Mexico | 130 |

| Ghana | 130 |

| Kazakhstan | 130 |

| Uzbekistan | 120 |

| Indonesia | 100 |

| South Africa | 100 |

| Peru | 100 |

| Brazil | 70 |

| Mali | 70 |

| Tanzania | 60 |

| Colombia | 60 |

| Burkina Faso | 60 |

| TOTAL | 2,470 |

In 2025, 17 countries produced 66 percent of the global production of gold.

Given there are 195 recognized countries, the remaining 178 states produced only 34% of world production of Au.

As with most other walks of life, it all comes down to the 10/90 rule of thumb, whereby 10 percent of realtors make 90 percent of the market sales. Which means that the other 90 percent bring home 10 percent of the sales, between them. Ecstasy and agony, kinda, eh!

Given that supply has reached a historical apex, let us now turn to demand.

Demand side

There are four major sectors driving demand for gold: Investment (Exchange-traded fund – ETF), Central Banks (sovereign gold reserves), Jewelry (retail consumption), and Technology (industrial manufacturing).

Let us start by looking at Tech. In 2025, this sector provided a stable demand, supporting electronics, as gold is the best conductor around. Demand was impacted by high prices and industrial tariffs.

So, Tech did not drive price up.

Jewelry – volume of sales registered a dramatic double digit percentage decline posting an 18% decrease compared to Q3 2024.

This did not mean the sales of gold jewelry went down. They didn’t. They went up driven by high prices and inflation. In some parts of the world like China, Au jewelry sales rose significantly upwards of 35% above the 10-year average. That is insane.

Bottom line, sales volume went down but the value went drastically up. Interesting, eh!

Central Banks – they were in a purchasing frenzy as they went after every ounce of gold tendered. China, as always, extended its purchasing streak, that was driven, according to some analysts, by economic instability.

Be that as it may, but I ain’t buying it. Not on its own merits. I do believe there is more beneath the surface. Let us scratch at it, as they say in the gold scratching business. 🙂

I think China, one of the world hoarders of gold, is increasing its holdings because like the rest of the BRICS, they are trying to hedge away from the mighty dollar. I do believe the BRICS are moving towards adopting a common currency backed by gold. But this is a story for another time.

For now, let us note that China has increased its Au reserves by 5 tonnes in Q4 2025 alone. This move came at a steep cost, which is equivalent to 10 tonnes of gold at the price point of Q4 2024. In other words, China decided to spend twice as much money for the same amount of precious bullion. Obviously, China knows something the rest of the world seems oblivious about.

Brazil purchased 15 tonnes of gold in Q4 2025. 15 tonnes, people! That is 3 x what China sent to her vaults. If this is not an indication of the BRICS fixing to start their own gold backed currency, I don’t know what is. BTW, the rest of the BRICS are well set off for gold and may have even stopped reporting it, as I suspect Russia and India to have done. After all, we live in war times, and information is knowledge in peace time. In times of war, information becomes state secrets.

I rest my case.

| Country | Last | Previous | Reference | Unit |

| United States | 8133 | 8133 | Sep/25 | Tonnes |

| Germany | 3350 | 3350 | Sep/25 | Tonnes |

| Italy | 2452 | 2452 | Sep/25 | Tonnes |

| France | 2437 | 2437 | Sep/25 | Tonnes |

| Russia | 2330 | 2330 | Sep/25 | Tonnes |

| China | 2304 | 2299 | Sep/25 | Tonnes |

| Switzerland | 1040 | 1040 | Sep/25 | Tonnes |

| India | 880 | 880 | Sep/25 | Tonnes |

| Japan | 846 | 846 | Sep/25 | Tonnes |

| Türkiye | 641 | 635 | Sep/25 | Tonnes |

| Netherlands | 612 | 312 | Sep/25 | Tonnes |

| Poland | 515 | 515 | Sep/25 | Tonnes |

| Euro Area | 507 | 507 | Sep/25 | Tonnes |

| Taiwan | 424 | 424 | Mar/25 | Tonnes |

| Portugal | 383 | 383 | Sep/25 | Tonnes |

| Uzbekistan | 361 | 365 | Sep/25 | Tonnes |

| Kazakhstan | 324 | 306 | Sep/25 | Tonnes |

| Saudi Arabia | 323 | 323 | Mar/25 | Tonnes |

| United Kingdom | 310 | 310 | Sep/25 | Tonnes |

| Lebanon | 287 | 287 | Mar/25 | Tonnes |

| Spain | 282 | 282 | Sep/25 | Tonnes |

| Austria | 280 | 280 | Sep/25 | Tonnes |

| Thailand | 235 | 235 | Sep/25 | Tonnes |

| Belgium | 227 | 227 | Sep/25 | Tonnes |

| Singapore | 205 | 204 | Sep/25 | Tonnes |

| Azerbaijan | 185 | 181 | Sep/25 | Tonnes |

| Algeria | 174 | 174 | Jun/25 | Tonnes |

| Iraq | 165 | 163 | Jun/25 | Tonnes |

| Libya | 147 | 147 | Sep/25 | Tonnes |

| Brazil | 145 | 130 | Sep/25 | Tonnes |

| Philippines | 132 | 130 | Sep/25 | Tonnes |

| Egypt | 129 | 129 | Sep/25 | Tonnes |

| Sweden | 126 | 126 | Sep/25 | Tonnes |

| South Africa | 125 | 125 | Sep/25 | Tonnes |

| Mexico | 120 | 120 | Sep/25 | Tonnes |

| Qatar | 116 | 116 | Sep/25 | Tonnes |

| Greece | 115 | 115 | Sep/25 | Tonnes |

| Hungary | 110 | 110 | Sep/25 | Tonnes |

| South Korea | 104 | 404 | Jun/25 | Tonnes |

| Romania | 104 | 104 | Sep/25 | Tonnes |

At this point in time, economic instability is not the main driver of the major gold price increase. The world has seen economic instability in 2020-2022. Even before that, we’ve had the big recession of 2009-2011. Central Banks did not go on a buying frenzy then, as they did in H1 (Jan-Jun) 2025. Did you know that this fall, AInvest reported that in the first six months of this year, central banks added 410 tonnes of gold to their reserves. That is 24% above the 5-year average.

I’d be very surprised not to see this figure double or more, by the time the final stats come out for 2025. And if that was the case, what would that tell us?

It would tell us the story of a scared world, trying, desperately trying to hedge its bets, by dropping all its useless paper and trading it for solid bullion. Because when you hoard 25% of the world’s gold production, that’s what you call a bad year for global investment and also a solid save. Life is a Paradox, eh!

Finally, we arrive at the last pillar driving demand for Au: Investment.

Investment – in 2025, a huge appetite for ETF buying and consistent bar/coin demand have fueled record investment flows. And if normally, traders and bankers advise investors to invest 10% of assets in solid gold, and the rest in paper (bonds through cash), this time we know that gold’s weight within the investment portfolios is a bit higher.

I wouldn’t be able to hazard a guess as to how high that figure is because I am not in the guessing business. And I won’t disappoint you by engaging in useless conjecture. However, I wouldn’t trust any figures reported on in the media either. They are either low-balling or high-balling the reality, because they are all mortally afraid of the geopolitical uncertainty.

And this is the main reason why there is so much disinformation and misinformation going around. This is also why I won’t add to it. It’s up to you, good folks, to figure out how much you trust paper money, government bonds, treasury certificates, fiat currencies, OR solid gold coins, bars, and bullion.

All I will tell you is this. The world is at war. There are two camps taking shape before our very eyes. The West and the East. The West is USA and its allies, whoever they may be. The East is BRICS and their allies, whoever they may be.

Right now, we do not yet know who will emerge victorious in this war for resources, trade, capital, waged via hard and soft power. And because there is no way to know which way the fortunes of war will go, either to the mountain of gold (USA & Co.) OR the mountain of iron (BRICS & Co.), the world is mired in Geopolitical Instability.

Geopolitical Instability is another word describing this World War 3.

Future Trends

War is the main driver of gold price. War is scary. War is the symbol of unpredictability. And what do people do when they cannot predict future? They hedge against it, by hoarding gold.

When this happens, its price goes up. After all, if the quantity cannot be eased, then the price will adjust upwards, making the commodity more expensive, as more buyers line up for the same physical amount.

Right now, gold trades around $4,500 per oz. I predict that within a year it will trade for $6,000 or more. That is if the current geopolitical situation doesn’t change.

The War in Ukraine needs to stop if the price of gold is to stop increasing astronomically.

If a Peace Accord is signed and respected, gold will go down significantly, within 3 months of the ink drying on the instruments of ratification. I expect it to go as low as $3,000 per oz. Not lower, since speculators will intervene to control the market and make money out of minor fluctuations.

Gold may never go back to antebellum levels of $1,500-2,000 per oz. That is out of the question.

If an Armistice is reached, gold will dip by $500 overnight. It won’t stay down for more than a few days or maybe a fortnight. After all, the blasted speculators gotta make some doe too, eh! Not sure it will jump back to the pre-Armistice high but it will go back up for sure.

If, however, the War continues, gold will keep on breaking ceiling after ceiling until it becomes the ultimate value, which it’s always been. If the conditions that exacerbated its rise continue, the market price will keep increasing until the said conditions change.

As for other precious metals, like Silver, Palladium or Platinum, you might have noticed how they appreciated as well. This goes to show that even poor people have seized on the need to save their hard earned cash by switching to financial instruments of real value.

This is a clear indication of how truly screwed the world is.

At this time, we ought to pray for Peace, not just for the sake of our financial security, but also because if we have Peace, we have a chance to survive long enough to change our lives around.