There used to be a time about 150 years ago, when in America, a furious debate inflamed the nation’s currency connoisseurs a.k.a. Mister Everybody.

On one side of the aisle were the partisans of the gold standard, who firmly believed that the nation’s greenback must be supported solely by a metallic counterpart that shone bright yellow.

On the other side of the debate were those who swore by both precious metals. They swore by the bold idea of a dual or bi-metallic standard backing the nation’s paper-money.

Now, I may not know a lot about precious metals, but I do know this much.

I know that for the most part of history, 12 grams of pure silver would get you 1 single gram of pure gold. In other words, mutatis mutandis or all things being equal, 12 oz. of .999 silver would buy you 1 oz. of 24 kt. gold.

Right now, that equilibrium has been skewed even further.

Today, 1 gram of Au will get you 48 grams of Ag. Make of this what you will.

Gold is nowadays at a historical premium. Wartime, what do you want!

I also know that most people for most part of history would earn their keep in bronze, brass or other such baseless metallic coinage. With such coins they’d purchase the simple necessities of life, such as sustenance, drink, etc.

A few, quite a few less destitute or more well-off but not affluent folk, would perhaps earn and save their cash in the form of silver coins. With these, they’d buy means of locomotion or beasts of burden, or even pay the rent, or purchase a modest dwelling. Dowries would also be saved over time and remitted in silver coins. So, larger transactions would be transacted in silver. And for most of History, silver was indeed king, especially among the general populace.

But nothing said more that one made it into the world than a person’s acquisition, multiplication, saving, and disbursing of the noblest metals of them all. I am talking, of course, about Gold.

Apropos silver and gold coins, throughout History, people had the custom whenever they didn’t trust the person producing the coinage, to bite into the gold and silver pieces. You see, Government has always tried to pull the wool over the people’s heads by devaluing currency whenever it suited them to do so.

But back then, metallic coinage would be struck in the official mint. This meant that the normally pure or .999 gold or silver coins, which are very malleable, would sometimes be devalued by adding non-precious metal. But doing so would render the coinage non-malleable. The basic difference between .999 gold (24 kt), .750 (18 kt), .585 (14 kt), or .417 (10 kt) gold is that 24 kt gold is malleable and all other grades are not.

One could always check government issued currency by biting into the coins. If you could sink your teeth into the gold coins, that meant your mint had not devalued the coinage. For silver coins, the rule was a bit different. You see, the mint would normally alloy them with other metals to make them less malleable and more robust. But forgers used to use antimony, arsenic, and good old lead, to counterfeit silver coins.

So, the rule of thumb was you bit gold coins. If your teeth made an indentation, that was good. The coin was legitimate, which meant it was between 22 and 24 kt.

For silver, if you could sink your denture into the coin, you had a few problems. The coin was counterfeit, and you also had just poisoned yourself by ingesting lead, antimony, arsenic, which are all highly toxic. You see, silver coin forgers used various such ‘dirty’ alloys to replicate the look and feel of the original 22 to 24 kt coin.

It is true that by the 1800s, gold coins were no longer minted in the original 22-24 kt grade, which made them less malleable but by then counterfeiting coins had become harder, and forging paper money easier. So that’s that.

Gold has always been king. And for good measure.

Especially during inflation times. Particularly when everybody knows how governments worldwide like to pay for unnecessary wars by devaluing people’s savings. Today, they do that by printing money with so much ardour that they will soon force people out of burning through cash into literally burning piles of it to keep warm.

And this is the case since the paper fiat currency stopped being backed by gold since the 1930s. Worse still, in 1971, gold and paper money experienced a nasty divorce, which cemented this monumental and paradigm-shifting schism.

So, knowing all this, and being aware gold is really the only real protection people have, the only true firewall insulating them from governmental irresponsibility, when I read such a hit piece from an industry insider shill, I lose my sh…

https://www.cbc.ca/radio/thecurrent/costco-gold-bars-investment-1.6985367

First off, let’s start with the first element that reveals the phony nature of the beast.

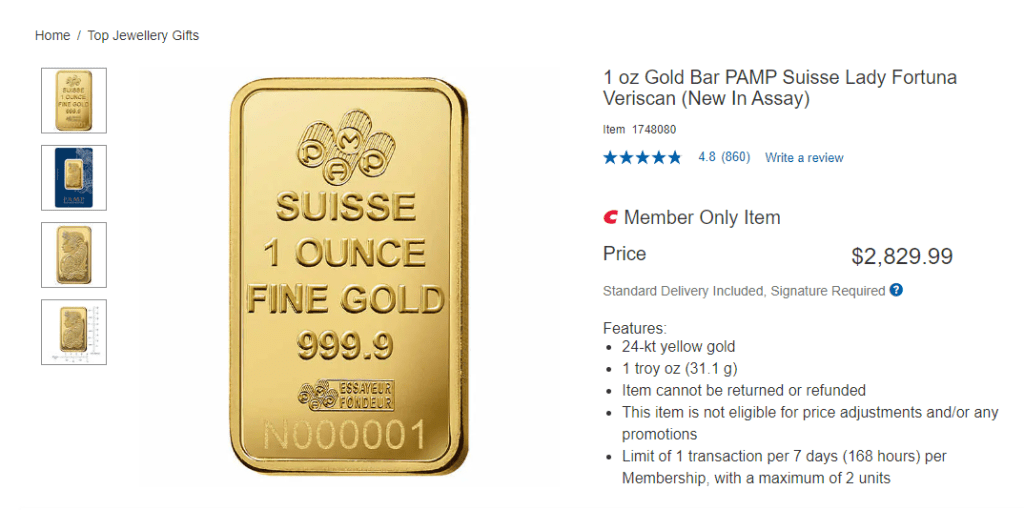

10 weeks ago, Costco was selling Canadian Mint 24 kt gold bars for $2,679.99 each.

Today, the same item sells for $2,829.99.

That’s a $150 total increase or $15 per week. That’s a 5.6 percent price hike over 2 1/2 months. This corresponds to an annual inflation rate of over 30 percent.

At the same time, salaries, wages, income have not kept up with the Joneses, i.e., cost of living.

Salaries only went up 5 to 10 percent in the last year. So, the gap, the creeping erosion in the purchasing power of the populace is somewhere north of 20 percent and perhaps as high as 25 percentage points.

And yet, the nincompoop who authored the article dared present the opinion of a so-called expert who argued that it’s better to buy government bonds yielding 5 percent annually, rather than invest in gold. Which appreciated 5.6 percent in 2 1/2 months alone.

This is insane. We are then expected to suspend our disbelief, flee gold, and run towards paper money, which continues to lose its fiat worthiness with every passing month.

The man is a charlatan. He argues with a straight face that we are not to buy gold because, and get a hold of this, because gold cannot be easily moved or transformed back into cash.

He says, and I am sorry, but I cannot keep a straight face as I type this as fast as my fingers can keep up with my stream of consciousness, he says that the brokerage fee (0.5 to 1%) levied by a bank on gold transactions is the one breaking the proverbial camel’s back.

Are you mad, sir?! I mean it. Are you gone out of your mind? Because last I checked if 1 oz of 24 kt gold was worth $2,700 of our Canadian Monopoly money, and the brokerage fee for cashing it in was 1 percent, that means one would have to pay $27 (an average fast-food menu).

Are we all supposed to buy in into your brand of buffoonery? Do you take us all for trained monkeys whose arithmetic skills stopped developing in Grade 1? Are we supposed to take your word for it and stop looking at the evidence? You clearly seem to think so.

Fact is the Money Hustlers (i.e., government, banking system, elites), they all want us poor. They want us destitute, in the poor house, indigent, so that we lose our Free Will, Agency, and become true Wards of the State and of their bloody System. You can draw your own conclusions.

If we all prepared for the coming shock by hedging our future on gold, they’d be left out holding paper currency in their greedy hands. And we all know what paper is good for. Yeah, that’s right. Paper is suited for wiping one’s derriere after one has moved one’s bowels.

Whereas gold is not suited for this natural but revolting purpose.

If an apple a day keeps the doctor at bay, then a bar of gold a day keeps the Thieves away.

Feel free to take this advice to the bank. I am confident they will cash it out in spite of what the money hustlers will tell you.

Perhaps sometime soon, I shall tell you just how bad Inflation is.

Hint